Mumbai Property News

Latest real estate news, market updates, new launches and expert analysis

Infrastructure & Real Estate Outlook 2025

Metro, coastal road & their impact on property prices

Best Residential Buildings

Top luxury towers across Mumbai neighborhoods

Property Rates 2025

Live rental & sale rates across 50+ locations

Neighborhood Guide

Explore Mumbai areas with rent data & lifestyle info

Sobha Inizio – The New Landmark of Parel: Mumbai’s Finest Boutique Address

Sobha Inizio – The New Landmark of Parel: Mumbai’s Finest Boutique Address Step into the world of Sobha Inizio, Sobha Limited’s maiden Mumbai...

Kalpataru Andheri West – New Launch Luxury Project in Lokhandwala

Why Andheri West–Lokhandwala Is Becoming Mumbai’s Next Luxury Hub: The Kalpataru AdvantageAndheri West has always been one of Mumbai’s most...

Andheri West Commercial Property Market Review

Andheri West Commercial Property Market Review Andheri West is quietly emerging as one of Mumbai’s most powerful commercial growth corridors,...

Parinee I, Andheri West: How Grade-A Office Towers Are Becoming Mumbai’s New Lifestyle & Business Destinations

Where rooftop dining, media powerhouses, and modern workplaces come together.<p style="text-alig

Is This a Low Period for Real Estate? Absolutely Not

Where Is the Money Coming From in Today’s Real Estate Market?A Deep Dive into India’s New Age Home-Buying PowerIndia’s real estate market in 2025...

Why Malabar Hill and Nepean Sea Road Continue to Command Mumbai’s Highest Prices

In a city constantly expanding northward, Malabar Hill and Nepeansea Road remain immutable symbols of prestige — micro-markets where scarcity, he

Godrej Worli Project - New Launch at Worli - Trilogy

Introduction to Godrej Worli<span style="color: #0e0e0

Housing Societies Cannot Charge Extra Fees on Rented Flats Beyond Non-Occupancy Charges

Introduction A recent directive has clarified that housing societies cannot impose additional fees on members who rent out their flats, apart from...

Why NeoLiv is Betting on Khopoli: Mumbai’s Next Housing Growth Hub

Introduction Realty firm NeoLiv has acquired 17.5 acres of land in Khopoli, within the Mumbai Metropolitan Region (MMR), to develop a plotted...

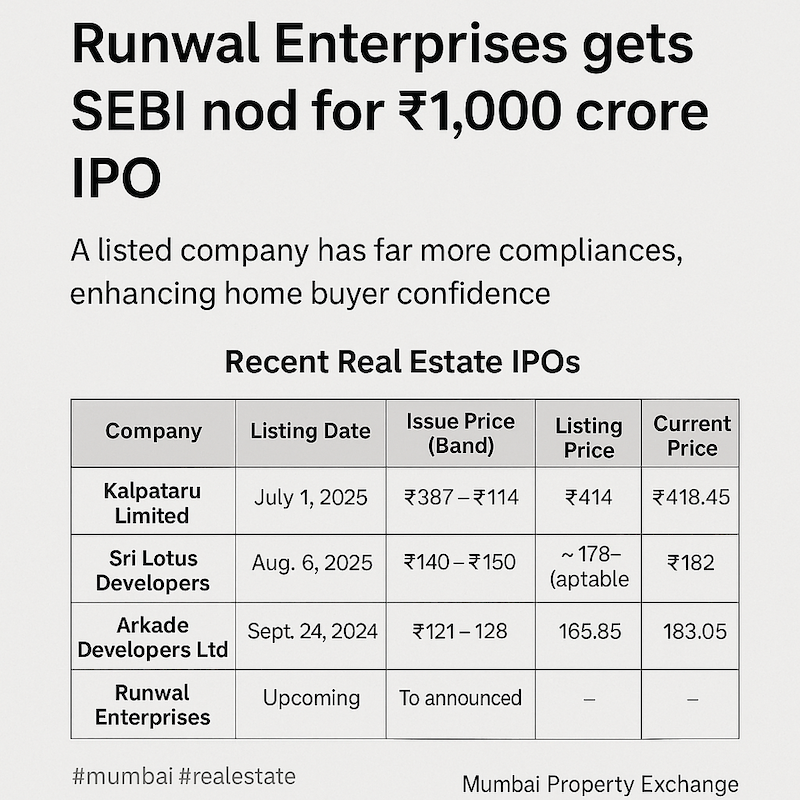

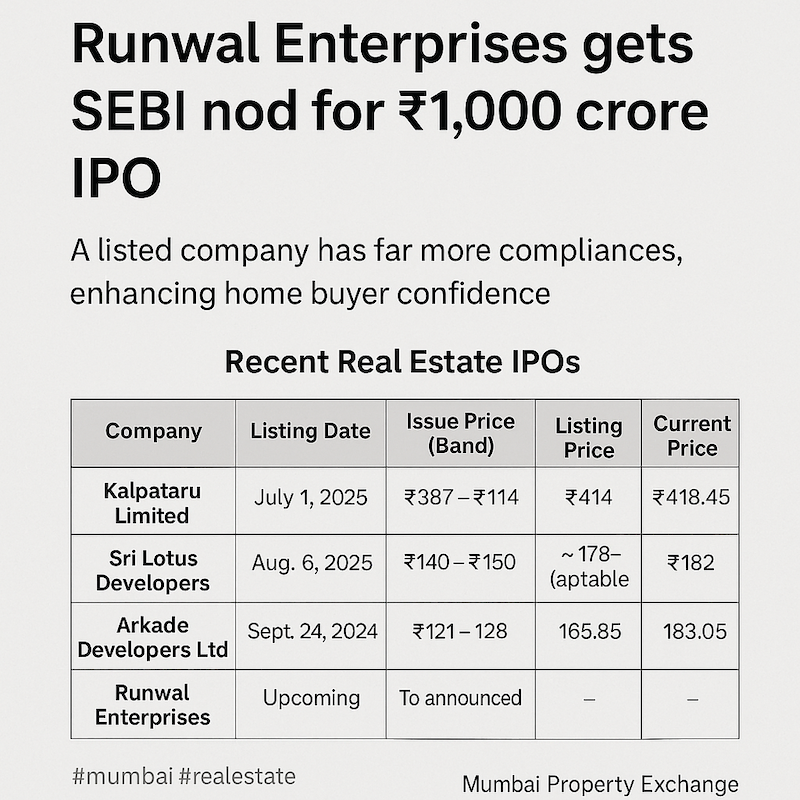

Runwal Enterprises Gets SEBI Nod for Rs.1,000 Crore IPO

Runwal Enterprises Gets SEBI Nod for Rs.1,000 Crore IPO Introduction Mumbai-based developer Runwal Enterprises has secured approval from the...

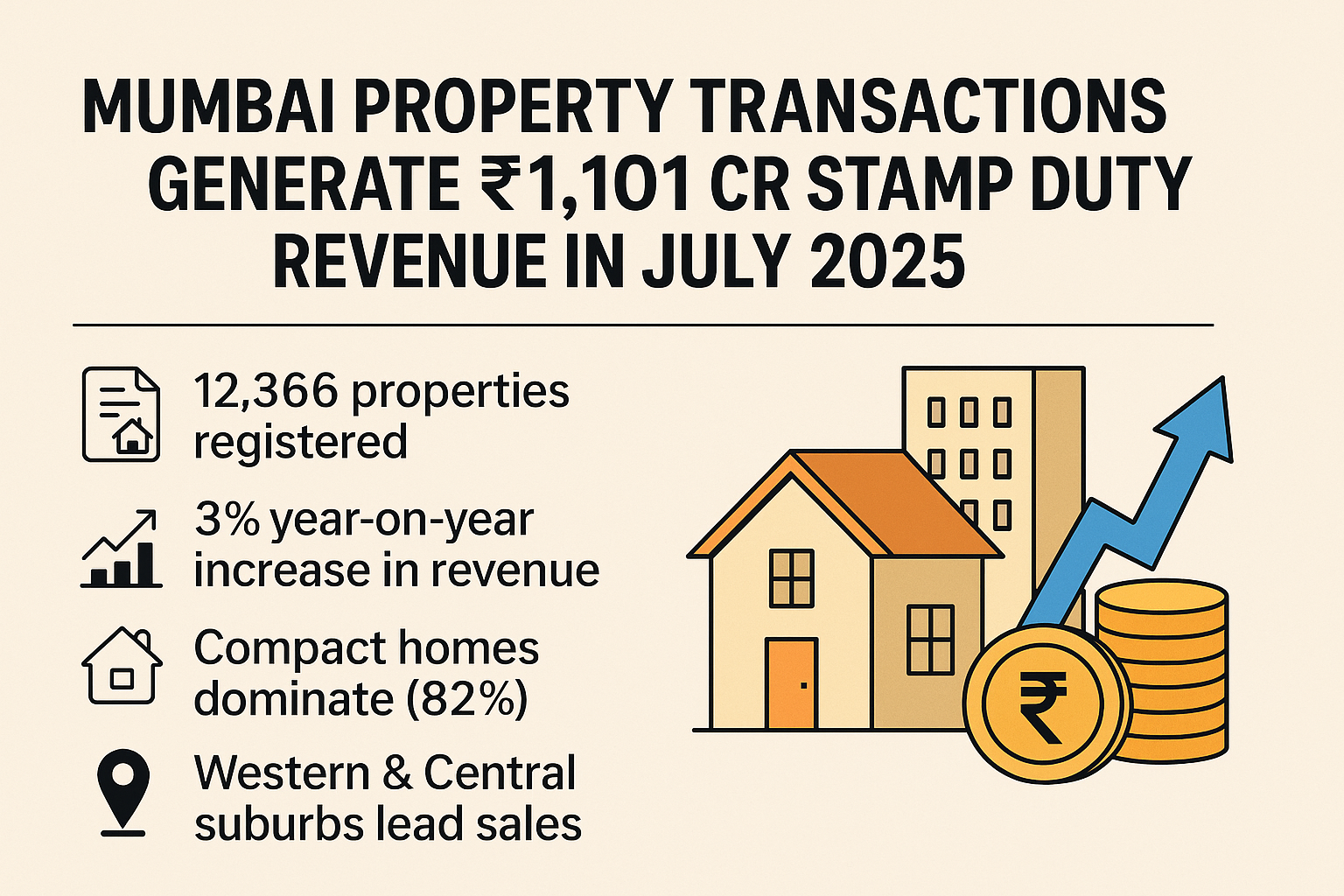

Mumbai Real Estate Sees Surge in Transactions and Stamp Duty Revenue – July 2025

Mumbai Clocks 1,101 Cr in Stamp Duty Revenue in July 2025: What It Means for Buyers & Sellers Mumbai’s real estate market continues to demonstrate...

Hubtown DLF Tardeo - 25 Downtown Settlement

Key take-aways from the Hubtown × DLF settlement ?800 crore exit price for DLF Twenty-Five Downtown (a Hubtown affiliate)