Latest Projects in Mumbai

RERA-registered developments across Mumbai

All

Projects

🏗️

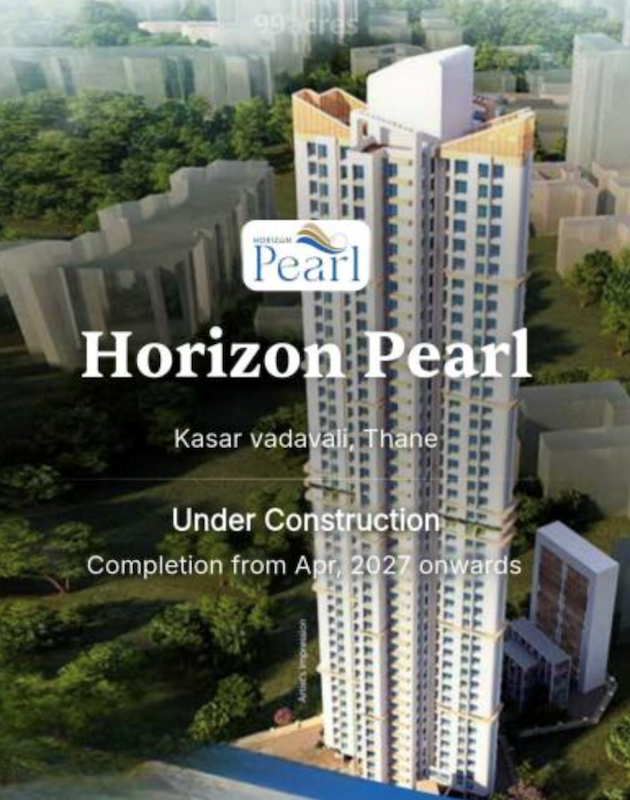

Under Construction

🆕

New Launch

✅

Completed

Interested in a project?

WhatsApp or call us for the latest rates and

availability.